Factors and trends

Overview

This section examines some of the high-level factors and trends which influence and drive the demand for skills.

This includes economic conditions and trends in the labour market, as well as other factors such as changes in society and culture, business and market, advancements in technology, implications arising from climate change and increasing emphasis on sustainable environmental practices, and policy, institutional, and regulatory requirements.

Drawing on information from the Industry Reference Committee (IRC) Skills Forecasts, this section identifies which factors are having a greater impact on different industries.

The report Future skills and training: A practical resource to help identify future skills and training provides more detail on some of the factors listed above and is available on the Australian Industry and Skills Committee (AISC) website.

Factors identified as having the greatest impact on industry are:

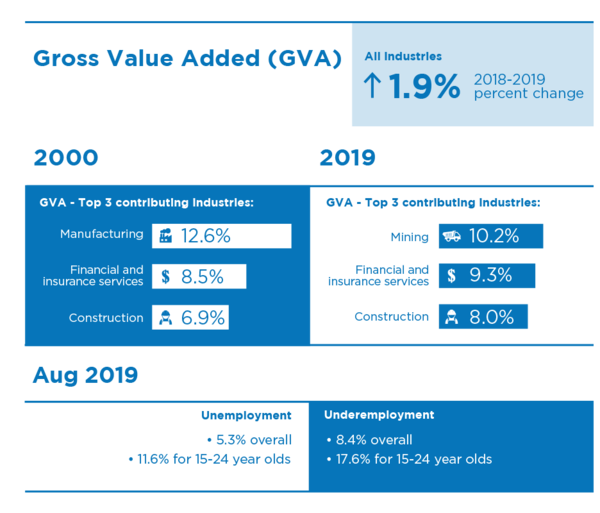

Economic conditions

Australia continues to experience growth and low unemployment. In 2019, the top three industries contributing to this growth were:

- Financial and insurance services

- Construction

- Mining.

Trends in the labour market

Industry employment level

Employment grew in absolute numbers for the majority of industries between 2000-2019. The main exceptions being the Agriculture, Manufacturing, and Information Media and Telecommunications industries, which saw a decline in their workforce over this period.

Industry and occupation structural change

There is an evident shift in industry structure. The industries with the largest decline between 2000 and 2019 (in terms of share of total employment) are:

- Manufacturing (5.4 percentage points)

- Agriculture, Forestry and Fishing (2.4 percentage points).

The industries with the largest increases have been:

- Health Care and Social Assistance (4.1 percentage points)

- Professional, Scientific and Technical Services (2.5 percentage points)

- Construction (1.3 percentage points).

Within these three industries, and noting that over this time the number of people employed across all industries has grown by 44%, some of the industry sectors with the largest growth are:

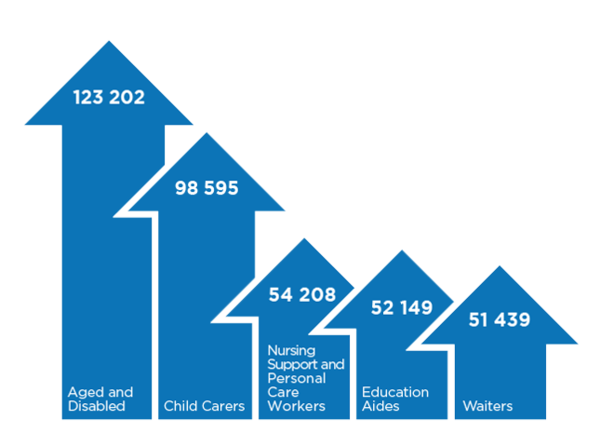

The occupational structure of the labour market has changed over the same period as well, with higher-level skills increasingly more in demand. The occupation grouping with the largest growth is Professionals (increasing their share by 5.8 percentage points). The second largest increase is Community and Personal Service Workers (increasing its share by 2.9 percentage points).

Within the Community and Personal Service Workers category, for occupations where there were at least 20,000 people employed in 2019, the largest percentage increases between 2000 and 2019 are:

In terms of numbers employed however, the largest increases were:

In most industries part-time employment is also growing. The industries with the largest increases in part-time employment (as a proportion of total employment between 2000 and 2019) were Accommodation and Food Services (10.9 percentage point increase), and Electricity, Gas, Water and Waste Services (10.0 percentage point increase).

Demographic trends

Australia’s ageing population and workforce is affecting industries differently. In 2019, there were nine industries with 30% or more of their workforce aged 50 and over. More than half of Agriculture, Forestry and Fishing workers were 50 years or older (54.3%), but only 15.1% of Accommodation and Food Services workers were of that age.

Since 2000, there has been an increase in the proportion of the workforce aged 50 years and over in all industries. The industries which have seen the largest increase in the proportion of the workforce aged 50 and over are:

- Agriculture, Forestry and Fishing (18.2 percentage points)

- Public Administration and Safety (14.9 percentage points)

- Electricity, Gas, Water and Waste Services (11.4 percentage points)

- Transport, Postal and Warehousing (11.3 percentage points)

- Wholesale Trade (10.7 percentage points)

- Healthcare and Social Assistance (10.0 percentage points)

Shifts in gender participation has varied across industry and occupation groups. For many industries, there was little change in the proportion of the female workforce between 2000 to 2019. Industries which have seen the largest growth in the female workforce are Other Services (8.5 percentage points), Public Administration and Safety (6.8 percentage points), Rental Hiring and Real Estate Services (6.4 percentage points) and Mining (5.7 percentage points).

Among occupation groups, Managers and Professionals have seen the strongest increase in the female proportion of the workforce between 2000 and 2019, with 8.1 percentage point and 5.3 percentage point increases respectively.

Factors influencing the demand for skills

The Miles Morgan report, Future skills and training, identifies a number of factors and trends currently driving and influencing the demand for skills in Australia and internationally. The factors are grouped into five overarching clusters: society and culture, business and economics, technology, resources and environment, and policy and regulatory. Below is a brief overview of these factors, with more detailed information available in the Future skills and training report.

Society and culture

This group of factors relate to changes in society and culture which have implications on the labour market and skills.

Society and culture-related factors which affect the labour market include:

- Demographic changes, such as population growth and an ageing population and their impact on the workforce and markets, including industry adaptation to the diversity of workforce aspirations and experience

- Globalisation and its impact on mobility, migration and international markets

- Changing work and career values with a greater emphasis on flexible working arrangements, work/life balance and increase in part time work

- Attracting and retaining a workforce

- Suitably skilled workforce and access to suitable training

- Urbanisation and implications for regional, rural and remote areas

- Increased participation by women and gender-related disparity

- Increasing participation by equity groups

- Workforce vulnerability due to automation and cost reduction strategies.

The majority of IRC Skills Forecasts identify at least one society and culture factor which has had an impact on their industry sectors. The following industries identify more than one society and culture factor:

- Animal Care and Management

- Aquaculture and Wild Catch

- Business Services

- Community Services

- Construction

- Corrections and Public Safety – Correctional Services

- Education

- Electrotechnology

- Food and Pharmaceutical Product Manufacturing

- Forestry and Wood Products

- Government Services

- Health

- Manufacturing – Textiles, Clothing and Footwear

- Racing

- Retail and Wholesale

- Transport

- Utilities – Water.

The most prominent society and culture factor is demographic changes, particularly Australia’s ageing population, but also population growth. Many industries cite an ageing workforce as being a potential challenge. The following quotes highlight just a few of the many industries experiencing challenges associated with an ageing workforce and population:

The agricultural labour force is aging, with the average age of a farmer 17 years older than the average worker. (Agriculture, Horticulture and Land Management IRC’s 2019 Skills Forecast)

The implications of an ageing workforce means that the sector is likely to experience high levels of staff leaving the workforce due to retirement or making lifestyle, financial or health based choices to reduce working hours. (Direct Client Care IRC’s 2019 Skills Forecast)

Such substantial changes in the age of the population will certainly put increasing pressures on health services as the prevalence of chronic pain conditions rises. Demand for ambulance services are among the many health services which are expected to significantly increase due to the growing ageing population and the related trend in favour of senior Australians continuing to live independently in their own homes. (Ambulance and Paramedic IRC’s 2019 Skills Forecast)

However, the ageing population is also creating new markets and new opportunities for some industries:

While purchasing intentions for four- and five-door vehicles remain high, they have declined year-on-year by 18 per cent and 36 per cent, respectively. This trend is likely being supported by stronger SUV demand from baby boomers. For example, survey results suggest almost 38 per cent of baby boomers in the market for a new car are looking to buy a SUV – up from less than 16 per cent a decade ago. (Automotive Combined IRC’s 2019 Skills Forecast)

Increasing demand for financial advice from superannuates, as growing post-retirement wealth creates a greater incentive to seek professional financial advice. Ability to assist clients through the potential emotional and psychological stress of retirement will also be crucial. (Financial Services IRC’s 2019 Skills Forecast)

Other factors mentioned among IRC Skills Forecasts include:

- Attracting and retaining a workforce, including attracting younger workers, reducing high staff turnover, and changes to visa arrangements reducing access to overseas workers

- Increasing participation by equity groups, including promoting employment opportunities for people with disabilities and mature age workers, as well as responding to the growing needs of an ageing population who have a diversity of chronic conditions and disabilities,

- Globalisation and its impact on mobility, migration and international markets

- Changing work and career values / flexible working arrangements, work/life balance and part-time work

- Increased participation by women / gender disparity

- Workforce vulnerability due to automation and cost reduction strategies.

Business and economics

These factors relate to trends in business and markets which influences how companies do business. Factors include:

- High-speed competition and workplace dynamics involving re-organisation of human resources to sustain competition

- Start-up thinking (including entrepreneurialism, freelancing and contracting)

- Emerging or changing markets

- Skills mismatch, shortages or gaps

- Network working and producing and supply chain management

- Knowledge-based economy

- Empowered customers, and changing work and career values

- A growing demand for care-related services and products.

Many of the IRC Skills Forecasts discuss business and economics factors affecting their industry sectors. The following industries identify more than one business and economics factor which impacts on their industry:

- Agriculture

- Animal Care and Management

- Aquaculture and Wild Catch

- Financial Services – Insurance and Superannuation

- Food and Pharmaceutical Production – Meat

- Health

- Information and Communications Technology

- Personal Services – Beauty

- Pulp and Paper Manufacturing

- Utilities – ESI Transmission, Distribution and Rail

There were a variety of business and economics-related factors mentioned across the skills forecasts. Some of these factors were named across several IRC skills forecasts while some were identified less often. For some industries factors related to skills mismatch, shortages or gaps, including challenges associated with finding an appropriately skilled workforce, and job market demand exceeding the supply of appropriately skilled graduates. A few examples of these business and economics-related factors across some industries include:

Similar to other sectors, local government is experiencing significant skills shortages. In a recent ALGA survey, results showed that approximately 70% of councils are currently experiencing skills shortages. The top 10 professional skill shortage occupations uncovered showed that some of the occupations are supported by the Training Package, including Environmental Health Officers and Project Managers. (Local Government IRC’s 2019 Skills Forecast)

With the current rate of solar uptake, there is a reported shortage of qualified electricians with the necessary skills for the installation and maintenance of solar systems. Consequently, the related skills in the Electrotechnology industry need to change accordingly to meet the industry needs. (Electrotechnology IRC’s 2019 Skills Forecast)

The job market for graduates is currently larger than the supply of graduates, with estimates suggesting that in some situations there could be a discrepancy of up to five times, emphasising the complex and challenging contexts in which the agricultural industries operate. (Agriculture, Horticulture and Land Management IRC’s 2019 Skills Forecast)

Other business and economics-related factors mentioned related to:

- Emerging or changing markets, including the growth in products and services for an ageing population

- Growing demand for care-related services and products, such as an increasing demand for health services, particularly within the area of complex and long-term care

- Empowered customers, and changing work and career values, including consumer demands for more sustainable products.

Technology

This group of factors cover the ever-evolving nature of technology and the implications it has for the workforce and skills needs. Factors include:

- Emerging technologies

- Digitisation and the Internet of Things, mobility and connectivity

- Big data and data analytics

- Artificial Intelligence (AI) and machine learning

- Automation and robotics (including drones)

- More technologically advanced materials and products

- Augmented Reality and virtual reality

- Optimising brain and cross-disciplinary science.

The vast majority of IRC Skills Forecasts identify technology factors as an issue affecting their industry sectors. Indeed, technology-related trends were raised more often than any of the other trends in the IRC Skills Forecasts. The following industries identify more than one technology factor which impacts on their industry:

- Agriculture

- Aquaculture and Wild Catch

- Arts, Culture, Entertainment and Design

- Business Services

- Community Services – Client Services

- Construction

- Corrections and Public Safety

- Electrotechnology

- Financial Services

- Forestry and Wood Products

- Government

- Health – Dental

- Information and Communications Technology

- Manufacturing – Metals, Engineering and Boating Industries

- Mining, Drilling and Civil Infrastructure – Civil Infrastructure

- Printing and Graphic Arts

- Property Services

- Retail and Wholesale

- Tourism, Travel and Hospitality

- Transport

- Utilities.

The most prominent technology factors were automation and robotics (including drones), and digitisation and the Internet of Things, mobility and connectivity. Several industries cite automation as providing a range of benefits, including improved workforce efficiency, enabling remote operations, and cost reduction in many areas. Mobility and connectivity have been identified by some industries as enabling market expansion, while digitisation and the Internet of Things has for certain industries improved project management processes, as well streamlining warehousing and despatching processes. However, these technology factors have implications for the way work is conducted and therefore the skills mix required.

The following quotes provide an example of how technology is impacting some industries:

With over 37,000 kilometres of natural gas transmission pipelines, the gas industry is poised to benefit from robotics opportunities which enable remote operations and increase oversight of utilities and infrastructure…The workforce needs to have skills in collecting, modelling, and analysing data in remote or hard-to-access areas. (Gas IRC’s 2019 Skills Forecast)

Increasingly, employers are describing robotics and automation as imperatives for their businesses. Due to the likelihood that most manual processes will eventually be automated, employers are looking for laboratory services technicians, who are comfortable and practised in their use of automation. These workers will require higher skill levels to maximise the use of new technology. (Manufacturing and Engineering IRC’s 2019 Skills Forecast)

These technologies, utilising information from the connectivity of the Internet of Things concept, are changing consumers’ behaviour, enabling them to monitor and adjust their electricity usage on-demand. Consequently, the workforce will need to be skilled in digital literacy, cybersecurity, and data analytics to meaningfully interpret data to improve productivity and customer services. (Electrotechnology IRC’s 2019 Skills Forecast)

Other technology factors which are mentioned in some of the IRC Skills Forecasts include:

- Emerging technologies

- Big data and data analytics

- Artificial Intelligence (AI) and machine learning

- More technologically advanced materials and products

- Augmented reality and virtual reality.

Resources and environment

These factors cover issues such as climate change, international action on sustainability, as well as access to reliable internet, and the implication for business, the workforce and education and training. Factors include:

- Sustainability action, driving the demand for more sustainable products and services

- Climatic weather shifts and the impact of climate change

- Improving energy efficiency

- Access to quality internet

- Financial viability.

Less than half of the IRC Skills Forecasts discuss resources and environment factors as an issue affecting their industry sectors. The following industries mention more than one resources and environment factor:

- Amenity Horticulture and Conservation

- Aquaculture and Wild Catch

- Construction

- Forestry and Wood Products

- Printing and Graphic Arts

- Pulp and paper manufacturing

- Utilities.

The most prominent resources and environment factor is sustainability action, which is driving the demand for more sustainable products and services. Some industries cite sustainability action as being a potential challenge for the industry due to changing customer expectations and changes in approaches to business operations and challenges in meeting skill requirements. However, most industries identify sustainability action as leading to new opportunities and markets.

Some of the resource and environment factors identified include:

Hybrid and electric vehicles are becoming increasingly attractive alternatives to conventional vehicles. As at July 2018, consumer research indicates that the majority (52 per cent) of Australians aged 18 and over would ‘seriously consider buying’ a hybrid vehicle, representing a rise since previous survey results. Furthermore, survey results suggest over 60 per cent of Australians are willing to pay more for a car with ‘zero emissions’, supporting that environmental consciousness is a factor in car purchases. (Automotive Combined IRC’s 2019 Skills Forecast)

With increasing emphasis on climate change, sustainability and energy consumption, the smart and green construction industry is growing worldwide. Benefits of smart and green buildings include lower operating costs, increased value of buildings, higher rental and occupancy rates, and improved health and productivity of occupants. They also necessitate new knowledge and skills in occupational areas such as energy efficiency, new products and water conservation. (Construction Plumbing and Services IRC’s 2019 Skills Forecast)

Environmental sustainability will be important skills for workers as the sector continues to advance processes around disposal of waste and environmental hazards. This is reflected in standards and targets set by the industry and organisations such as the Australian Packaging Covenant Organisation to meet in order to reduce the impact of printing and packaging on the environment. (Printing and Graphic Arts IRC’s 2019 Skills Forecast)

Related to this, the effects of climate weather shifts and the impact of climate change were also discussed in a few of the IRC Skills Forecasts. This also leads to both challenges and opportunities in the need to adapt to changing expectations by both customers and governments. This also presents the need for a workforce that has the skills and knowledge required to respond and manage the various unique industry impacts of climate change and climate weather shifts. Other resources and environment factors identified by a few IRC Skills Forecasts include:

- Improving energy efficiency

- Access to quality internet.

Policy and regulatory

This group of factors covers the policy and regulatory factors which influence the demand for skills, including understanding and adhering to the regulatory environment, the policy environment and its implications for businesses and the workforce, and reform in the education and training sector. Factors include:

- Innovation ahead of regulation

- Policy environment

- Appetite for reform

- High and complex regulatory environment

- Safety requirements.

More than half of the IRC Skills Forecasts rank policy and regulatory factors as an issue affecting their industry sectors. The following industries mention more than one of these factors:

- Animal Care and Management

- Aquaculture and Wild Catch

- Community Services

- Construction

- Food and Pharmaceutical Production

- Health

- Racing

- Transport

- Utilities – ESI Generation.

The most prominent policy and regulatory factors mentioned across the IRC Skills Forecasts are policy environment and high and complex regulatory environment. For most industries a policy environment and a high and complex regulatory environment are part of the operational environment, either specific to the industry or applied more broadly, and can include:

- Licensed occupations

- Industry standards

- Legislation to manage and protect resources

- Workplace health and safety legislation

- Legislation to protect consumers (noting that these can vary by state or territory)

- Changes to government policy which at times can impact workforce operations, as well as require businesses to update core procedures and processes.

Many industry sectors report the need for business and compliance skills to enable the workforce to negotiate the regulatory environment. Regulation has also led to new technologies in some areas that require new skills. This can also have implications for training package development.

A few policy and regulatory factors identified by some industries include:

The sector is highly regulated across every level, meaning that businesses must adhere to overlapping international, national, state and local compliance legislation…Supporting sustainable fisheries and marine environments has also led to complex regulatory arrangements, licensing issues and quotas that have hampered productivity. (Aquaculture and Wild Catch IRC’s 2019 Skills Forecast)

Government policy/legislation changes – a number of national and state/territory-based Royal Commissions into areas of relevance for the CS&D sector (i.e. child protection, family violence, aged care, etc.) have released key recommendations impacting workforce practices…The introduction of minimum requirements for accreditation for providing statutory out-of-home care and adoption services (i.e. NSW Child Safe Standards for Permanent Care) will impact training and registration requirements of the workforce involved in child protection services. (Community Sector and Development IRC’s 2019 Skills Forecast)

The regulatory and policy environment pertaining to the VET sector is complicated, with numerous layers of State and Federal regulation and standards. This creates a complex operating environment for organisations as well as individual trainers and assessors who must stay abreast of varying requirements. (Education IRC’s 2019 Skills Forecast)

In contrast, at least one of the skills forecasts mention a lack of legislation and regulation around new technologies. An example of this is the Information and Communications Technology industry which conveyed concerns over regulation and standards being unable to keep up with the pace of new technology, therefore creating industry wide challenges relating to product quality.

Method and sources

Methodology

The factors and trends framework has largely been based on the factors outlined in the Miles Morgan report Future skills and training: A practical resource to help identify future skills and training. The report outlines a number of factors which are influencing the demand for skills in the following broad categories: society and culture, business and economics, technology, resources and the environment, policy and regulatory.

A systematic review of the Skills Forecasts from 2019 has been undertaken to identify which factors are most prevalent for the IRCs.

Employment data has also been provided to show how labour market trends have also been shaping the workforce between 2000 and 2019.

Sources

Australian Bureau of Statistics 2019, Gross Value Added (GVA) by Industry, 5204.0 – Table 5, viewed February 2020 https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/5204.02018-19?OpenDocument

- GVA percentage change, 2018-2019

- Top three contributing industries, 2000 and 2019

Australian Bureau of Statistics 2019, Underutilised persons by Age and Sex - Trend, Seasonally adjusted and Original, 6202.0 – Table 22, viewed February 2020 https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6202.0Jan%202020?OpenDocument

- Unemployment August 2019 (all and 15-24 year olds)

- Underemployment August 2019 (all and 15-24 year olds)

Australian Bureau of Statistics 2019, Employed persons by Industry group of main job (ANZSIC), sex, state and territory, November 1984 onwards, 6291.0.55.003 - EQ06, viewed February 2020, https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6291.0.55.003Nov%202019?OpenDocument

- Employed total by ANZSIC 1 digit Industry, 2000 to 2019, August Quarter

- Employed total, percentage change by ANZSIC 1 digit Industry, between 2000 and 2019, August Quarter

- Employed total, percentage change by ANZSIC 3 digit Industry group, between 2000 and 2019, August Quarter, for selected industry sectors

- Employment status, percentage change by ANZSIC 1 digit industry, between 2000 and 2019, August Quarter

Australian Bureau of Statistics 2019, Employed persons by Industry group of main job (ANZSIC), sex, state and territory, November 1984 onwards, 6291.0.55.003 - EQ09, viewed February 2020, https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6291.0.55.003Nov%202019?OpenDocument

- Employed total, proportion of females in workforce, percentage change by ANZSIC 1 digit Industry, between 2000 and 2019, August Quarter

Australian Bureau of Statistics 2019, Employed persons by occupation group of main job (ANZSCO), sex, state and territory, November 1984 onwards, 6291.0.55.003 - EQ08, viewed February 2020 https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6291.0.55.003Nov%202019?OpenDocument

- ANZSCO 1 digit occupation, percentage change between 2000 and 2019, August Quarter

- ANZSCO 4 digit occupation unit group, percentage change between 2000 and 2019, August Quarter

Australian Bureau of Statistics 2019, Employed persons by Age and Industry division of main job (ANZSIC), November 1984 onwards, 6291.0.55.003 – EQ12, viewed February 2020 https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6291.0.55.003Nov%202019?OpenDocument

- Employed total, proportion of workforce aged 49 and under and 50 and over by ANZSIC 1 digit level, 2019, August Quarter

- Employed total, proportion of the workforce aged 50 and over by ANZIC 1 digit level, percentage change difference between 2000 and 2019, August Quarter