Factors and trends

Overview

This section examines some of the high-level factors and trends which influence and drive the demand for skills.

This information includes economic conditions and trends in the labour market, as well as other factors such as changes in society and culture, business and market, advancements in technology, implications arising from climate change, increasing emphasis on sustainable environmental practices, and policy and regulatory requirements.

All data on this page should be considered in the context of the ongoing COVID-19 pandemic, which may impact key measures.

Drawing on information from the Industry Reference Committee (IRC) Skills Forecasts and Industry Outlooks from 2021, alongside other relevant industry literature, this section identifies which factors are having a greater impact across industries.

The report Future skills and training: A practical resource to help identify future skills and training provides more detail on some of the factors listed above and is available on the Australian Industry and Skills Committee (AISC) website.

Factors identified as having the greatest impact on industry are:

Economic conditions

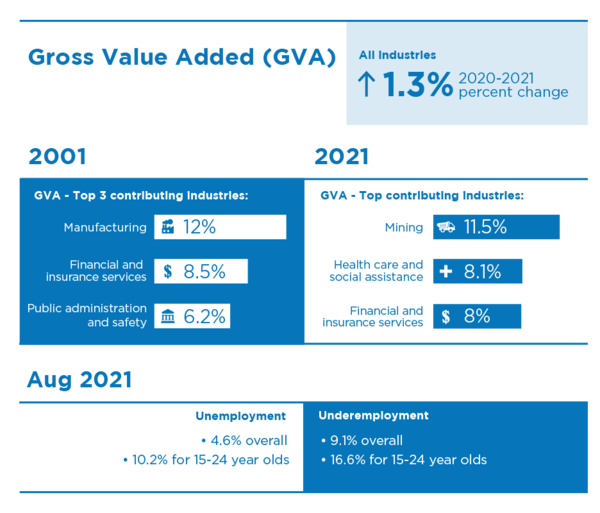

Despite the ongoing challenges of the COVID-19 pandemic Australia continues to experience growth and low unemployment. In 2021, the top three industries contributing to this growth were:

- Mining

- Health care and social assistance

- Financial and insurance services.

Trends in the labour market

Industry employment level

Employment grew in absolute numbers for most industries between 2001 and 2021. The exceptions are Agriculture, Forestry and Fishing; Manufacturing; and Information Media and Telecommunications industries, which saw a decline in their workforce over this period.

The COVID-19 pandemic which began in 2019 initially had a significant negative impact on the Australian labour market due to social and economic restrictions imposed by governments to control the spread of the virus. Since then, as restrictions have eased, the labour market has bounced back strongly although the recovery has varied widely by industry. Industries that have seen the largest percentage decline in employment numbers between 2019 and 2021 are:

- Arts and Recreation Services (-16.6%),

- Wholesale trade (-14.2%),

- Administrative and Support Services (-12.9%).

Industries with the largest percentage increase in employment numbers between 2019 and 2021 are:

- Financial and Insurance Services (17.4%),

- Mining (12.7%),

- Manufacturing (11.2%).

Employment levels are projected to increase in most industries over the next few years to 2025. The exceptions being Information Media and Telecommunications, and Manufacturing. Industries with the largest projected percentage employment growth from November 2020 to November 2025 are:

- Accommodation and Food Services (16.8%)

- Health Care and Social Assistance (14.2%)

- Professional, Scientific and Technical Services (11.0%).

The projections for the three industries above equate to approximately 520 500 additional workers.

Industry and occupation structural change

There is an evident shift in industry structure. The industries with the largest decline between 2001 and 2021 (in terms of share of total employment) are:

- Manufacturing (4.1 percentage points)

- Agriculture, Forestry and Fishing (2.5 percentage points)

- Retail Trade (1.9 percentage points).

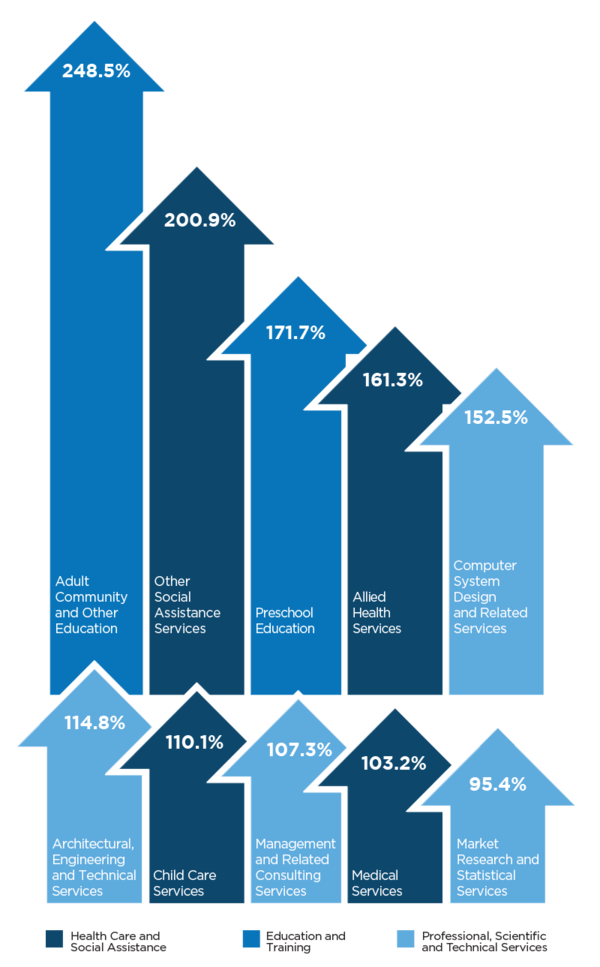

The industries with the largest increases in share of total employment have been:

- Health Care and Social Assistance (4.8 percentage points)

- Professional, Scientific and Technical Services (2.6 percentage points)

- Education and Training (1.2 percentage points).

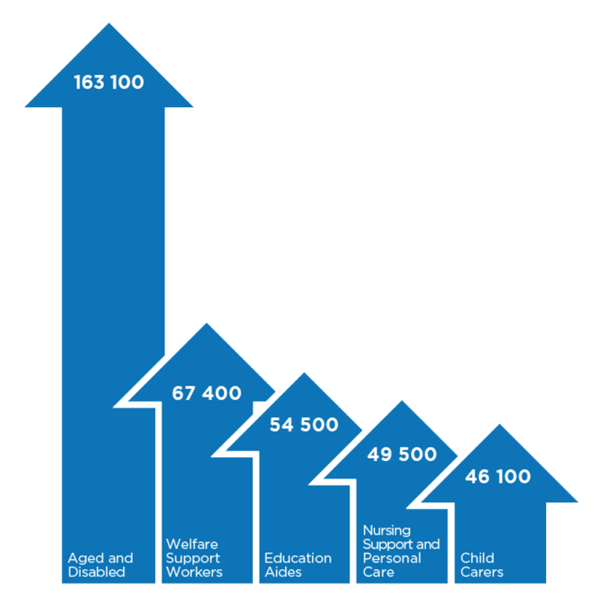

Within these three industries, and noting that over this time the number of people employed across all industries has grown by 41%, some of the industry sectors with the largest growth are:

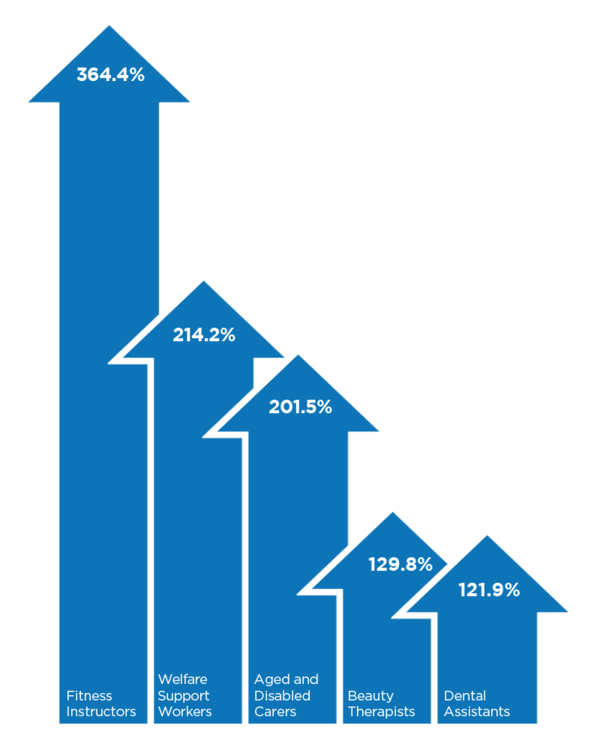

The occupational structure of the labour market has also changed over the same period, with higher-level skills increasingly more in demand. The occupation grouping with the largest growth is Professionals (increasing their share by 6.7 percentage points). The second-largest increase is Community and Personal Service Workers (increasing its share by 2.2 percentage points).

The occupational groupings with the largest decline in labour market share between 2001 and 2021 were Clerical and Administrative Workers (-3.2 percentage points), and Labourers (-2.5 percentage points). This reflects the global trend of increasing automation and efficiency for entry-level administrative or manual labouring positions that are characterised by repetitive tasks.

Within the Community and Personal Service Workers category, for occupations where there were at least 20,000 people employed in 2021, the largest percentage increases between 2001 and 2021 are:

In terms of numbers employed however, the largest increases were:

In most industries, part-time employment is also growing. The industries with the largest increases in part-time employment (as a proportion of total employment between 2001 and 2021) were Accommodation and Food Services (12.8 percentage point increase), and Manufacturing (6.2 percentage point increase). The industry with the largest decrease in the proportion of part-time workers was Financial and Insurance Services (-3.0 percentage points).

Demographic trends

Australia’s ageing population has led to an increasing share of older workers, however this trend varies widely across industries. For example, in 2021, more than half of Agriculture, Forestry and Fishing workers were 50 years or older (53.7%), in contrast, only 14.7% of Accommodation and Food Services workers were aged 50 or over. In total there were ten industries in 2021 with 30% or more of their workforce aged 50 and over.

Since 2001 all industries have seen an increase in the proportion of their workforce aged 50 years and over. Industries which have seen the largest increases are:

- Agriculture, Forestry and Fishing (18.0 percentage points)

- Transport Postal and Warehousing (13.6 percentage points)

- Wholesale Trade (12.9 percentage points)

- Rental, Hiring and Real Estate Services (12.8 percentage points)

- Electricity, Gas, Water and Waste Services (12.2 percentage points).

Shifts in gender participation have also varied across industry and occupation groups. For some industries, there was little change in the proportion of the female workforce between 2001 to 2021, other industries have seen an increase over this period. Industries that have seen the largest growth in the female workforce are Information Media and Telecommunications (8.6 percentage points), Mining (6.7 percentage points), and Other Services (6.5 percentage points).

Among occupation major groups, Professional and Managers have seen the largest increase in the female proportion of the workforce between 2001 and 2021, with 7.5 percentage point and 6.7 percentage point increases respectively.

Factors influencing the demand for skills

The Miles Morgan report, Future skills and training, identifies several factors and trends currently driving and influencing the demand for skills in Australia and internationally. The factors are grouped into five overarching clusters: society and culture, business and economics, technology, resources and environment, and policy and regulatory. Below is a brief overview of these factors, with more detailed information available in the Future skills and training report.

Society and culture

This group of factors relate to changes in society and culture which have implications on the labour market and skills.

Society and culture-related factors which affect the labour market include:

- Demographic changes, such as population growth and an ageing population and their impact on the workforce and markets, including industry adaptation to the diversity of workforce aspirations and experience

- Globalisation and its impact on mobility, migration and international markets

- Changing work and career values with a greater emphasis on flexible working arrangements, work/life balance and increase in part-time work

- Attracting and retaining a workforce

- Urbanisation and implications for regional, rural and remote areas

- Increased participation by women and gender-related disparity

- Increasing participation by equity groups

- Workforce vulnerability due to automation and cost reduction strategies.

An aging workforce

The most prominent society and culture factor identified by industries is demographic change, particularly Australia’s ageing population. Many industries cite an ageing workforce as being a potential challenge. The following quotes highlight just a few of the many industries experiencing challenges associated with an ageing workforce and population:

Attracting and retaining young workers remains a challenge for the industry. The current employment rate for those aged under 30 is approximately 11 per cent, which has the potential to negatively impact the industry. The Rail industry needs to work with parents and secondary education providers to create greater awareness of training and career pathways and apprenticeship and traineeship opportunities. (Rail IRC’s Industry Outlook 2021)

The industry has a large proportion (36 per cent) of older workers aged 50 or over, many of whom are projected to retire in the next 10-15 years. The pace of technological change and the capacity for the existing older workforce to adapt to the new technologies are a challenge for the industry. Water utilities need to continue to look at how they promote careers in the industry, particularly entry-level roles. (Water IRC’s Industry Outlook 2021)

However, the ageing population is also creating new markets and opportunities for some industries:

The ageing population will drive strong demand for health insurance, superannuation and financial advice over the medium to long term. (Financial Services IRC’s 2019 Skills Forecast)

Demand for Access Consultants is being driven by a heightened focus on community-based care and aging in place, supported by community care packages and the NDIS. These schemes are driving increased residential modifications requiring competent consultants to provide advice and compliance reporting. (Property Services IRC’s 2020 Skills Forecast)

Skilled migration

As the Miles Morgan report, Future skills and training identifies, skilled migration provides an opportunity for Australia to access a much larger pool of talent and increase diversity within the labour force. It also contributes to the Australian economy through population growth, the introduction of new technology, and the transfer of skills to the resident Australian workforce. However, the influx of skilled migrants has slowed over the last 5 years exacerbated by the closure of Australia’s international borders in response to the COVID-19 pandemic. During 2016—17 around 123 500 people entered Australia through the Skill Stream of the Permanent Migration Program. This number fell to just under 80 000 in 2020—21, representing a decline of approximately 36% (2020-21 Migration Program Report, Department of Home Affairs).

In addition to permanent skilled migration, employers can meet short-term skills needs through temporary visas. On 30 June 2021, there were approximately 55 030 Temporary Work (skilled) visa holders in Australia. This was down from around 90 590 Temporary Work (skilled) visa holders at 30 June 2017, representing a decline of 39% (Temporary work (skilled) visa program, Department of Home Affairs).

The following quotes provide examples of industries experiencing challenges associated with decreased access to skilled migrants:

COVID-19 saw many industry visa holders sought for their speciality skills return to their homes as the government closed borders and stopped international travel in the immediate response to the pandemic. As an example, arboriculture relies heavily on European and UK climbers to come and work in Australia. Their return home has created a massive shortage of climbers and hindered the completion of works. (Australian Agriculture, Horticulture, Conservation and Land Management IRC’s 2021 Skills Forecast)

Australia has historically relied on skilled migrants to fill workforce shortages across public and private infrastructure projects. However, border closures because of COVID-19 have placed a strain on businesses' ability to meet the current increase in demand for services. As borders begin to open there will be a greater focus from the public infrastructure sector on obtaining skilled migrants. (Infrastructure workforce and skills supply report, Infrastructure Australia 2021)

Lack of access to the global labour market over the last two years has meant that businesses skilling requirements have largely needed to have been met by Australia’s existing labour force. As Australian borders reopen it remains to be seen if the temporary interruption to the supply of skilled migrants will have longer-term impacts on the Australian workforce and economy.

Remote working

As the Productivity Commissions’ Working from home research paper highlights, one of the most significant impacts of the COVID-19 pandemic on businesses and employees is the forced experiment of working remotely from home.

Industries with a high percentage of office-based or ‘knowledge’ workers such as professional, scientific and technical services and information media and telecommunications had the largest percentage point increases in the proportion of employing businesses with some staff working from home. Conversely, industries requiring a great deal of on-site work, such as electricity, gas, water and waste services, or physical interactions with people, such as health care and social assistance, experienced a decrease in the proportion of businesses with staff working remotely since COVID-19.

The Productivity Commissions’ Working from home research paper notes that before the pandemic, working from home may have been discouraged by management policies, and cultural norms in workplaces. The report argues it is unlikely that Australia will return to pre-pandemic levels of working from home, given both employer and employee shifts in perspectives on this approach. Reasons posited include the benefits for employees of avoiding the daily commute to the office, along with flexible working arrangements, which suit other lifestyle factors such as childcare and out-of-work pursuits. Employers also came to recognise that remote working was potentially both feasible and beneficial to the business. The report concludes the process of trial and adaptation is likely to continue for some time as businesses adopt differing remote-working models, based on judgments on what will work best for them.

Other society and culture factors that industries have identified as important include:

- Attracting and retaining a workforce, including attracting younger workers, reducing high staff turnover, and changes to visa arrangements reducing access to overseas workers

- Increasing participation by equity groups, including promoting employment opportunities for people with disabilities and mature age workers, as well as responding to the growing needs of an ageing population who have a diversity of chronic conditions and disabilities,

- Changing work and career values / flexible working arrangements, work/life balance and part-time work

- Increased participation by women/gender disparity

- Workforce vulnerability due to automation and cost reduction strategies.

Business and economics

These factors relate to trends in business and economics which influence how companies operate. Factors include:

- High-speed competition and workplace dynamics involving re-organisation of human resources to sustain competition

- Start-up thinking (including entrepreneurialism, freelancing and contracting)

- Emerging or changing markets

- Skills mismatch, shortages or gaps

- Network working and producing and supply chain management

- Knowledge-based economy

- Empowered customers, and changing work and career values

- A growing demand for care-related services and products.

Skills in the workforce

One of the most important business and economic factors identified by many industries related to skills mismatch, shortages or gaps. This included challenges associated with finding an appropriately skilled workforce, and job market demand exceeding the supply of appropriately skilled graduates. According to the ABS Business Conditions and Sentiments Survey in June 2021, over a quarter of all employing businesses in Australia were having difficulty finding suitable staff - this rose to over a third of employing businesses in the following industries:

- Accommodation and Food Services (38%)

- Electricity, Gas, Water and Waste Services (37%)

- Other Services (36%)

- Manufacturing (35%).

The top three reasons given by employing businesses with difficulties finding staff to fill jobs were:

- Lack of applicants for jobs

- Applicants don’t have the skills or qualifications required for jobs

- International border closures limiting the recruitment pool.

A few examples of these skills mismatch, shortages or gaps-related factors in some industries include:

A significant number of apprenticeships were unfortunately suspended or terminated due to COVID-19, and skilled migration has been extensively disrupted, which will result in a shortage of qualified electrotechnology tradespeople in the near future (Electrotechnology IRC’s Industry Outlook 2021)

The industry has the opportunity to automate low-skill tasks. Retraining and up-skilling will be needed to ensure the workforce is well-informed of emerging technologies to maintain assets, and improve water utility efficiency. The workforce will require new skills in the use of visual technology and equipment deployed to monitor, inspect, maintain, and repair water network assets. (Water IRC’s Industry Outlook 2021)

More than 40 per cent of farmers report labour shortages during peak times (such as harvest) in a 'normal' year and there are concerns that, if strategies are not implemented to respond to increasingly acute labour shortages now, production costs are likely to grow or worse, producers' difficulties may lead to limited harvest outputs. (Australian Agriculture, Horticulture, Conservation and Land Management IRC Skills Forecast Update 2021)

Supply chain disruption

Another prominent business and economics factor identified by many industries are the challenges brought about by disruption to supply chains both globally and within Australia due to the COVID-19 pandemic. Data collected by the ABS Business Conditions and Sentiments Survey, indicate that supply chain disruption has worsened between April 2021 and January 2022 for many industries in Australia, with the three most impacted industries being:

- Wholesale Trade

- Retail Trade

- Manufacturing.

The following quotes from the Transport and Logistics Industry Outlook 2021 illustrate the supply chain challenges faced by the industry, and the innovations implemented in response to these pressures.

The global supply chain has been significantly affected by the pandemic and strict lockdown measures in many countries. There are unprecedented demands for critical products…….

The COVID-19 pandemic has caused serious disruptions to Australian supply chains. Whilst there has been an unprecedented demand for certain products and services, delivery was impacted by strict lockdowns and border closures in several states……..

Workers have had to work longer and harder to keep the supply chain flowing. COVID-19 expedited the digitalisation of businesses and increased the demand for e-commerce which exerted enormous pressure on the sector. The Australian Transport and Logistics sector has had to adapt and respond to the unanticipated impacts by increasing the implementation of digital innovations such as blockchain, the Internet of Things, and data analytics to improve operations and save costs.

Other business and economics-related factors mentioned by industries include:

- Emerging or changing markets, including the growth in products and services for an ageing population

- Growing demand for care-related services and products, such as an increasing demand for health services, particularly within the area of complex and long-term care

- Empowered customers, and changing work and career values, including consumer demands for more sustainable products.

Technology

This group of factors cover the ever-evolving nature of technology and the implications it has for the workforce and skills needs. Factors include:

- Emerging technologies

- Digitalisation and the Internet of Things, mobility and connectivity

- Big data and data analytics

- Artificial Intelligence (AI) and machine learning

- Automation and robotics (including drones)

- More technologically advanced materials and products

- Augmented Reality and virtual reality

- Optimising brain and cross-disciplinary science.

Although the pressures on employers to reskill and upskill their workforce due to technological changes existed before COVID-19, the pandemic has exacerbated and accelerated this requirement. As the Skills urgency report by Australian Industry Group posits, the implementation of new technologies and increased digitalisation of businesses have meant that the intrinsic nature of work in some industries has been forced to evolve rapidly. Advances in technology have largely resulted from changes in how businesses operate, and the way services are delivered. Factors driving these technological changes include:

- increased use of digital technologies and IT services due to COVID-19 restrictions in movements

- increased use of online shopping for products and services

- businesses increasing their online footprint

- increased proportion of the workforce working from home or remotely.

The most prominent technology factors highlighted by industries in Australia are automation and robotics (including drones), and digitisation and the Internet of Things, mobility and connectivity. Several industries cite automation as providing a range of benefits, including improved workforce efficiency, enabling remote operations, and cost reduction in many areas. Mobility and connectivity have been identified by some industries as enabling market expansion, while digitisation and the Internet of Things has for certain industries improved project management processes, as well as streamlining warehousing and dispatching processes. These technology factors have implications for the way work is conducted and therefore the skills mix required.

The following quotes provide an example of how technology is impacting some industries:

The pandemic has expedited the utilisation of electronic and communication systems which form the backbone of automated systems and smart devices. Many appliances and equipment at work/home are embedded with electronics which allow them to be controlled automatically and remotely with the help of radiofrequency (RF) communication systems and wireless technology. The Internet of Things relies on computer technology and RF communication systems. The increasing use of these systems requires workforce skills to be updated in accordance with the latest changes. (Electrotechnology IRC’s 2021 Industry Outlook)

The use of technology in managing public safety matters, including drones, predictive tools, and remote learning, will continue to grow. Developments in technology will have ongoing impacts on police training, particularly in specialist areas such as remotely piloted aircraft (drones), cybercrime and investigations. (Public Safety IRC’s 2021 Industry Outlook)

The implementation of digitalisation and automation are gaining more pace in the Maritime industry. Underwater or surface autonomous vessels equipped with a range of data collection technologies are currently in operation. Autonomous technology will reshape the industry’s technology-based operational systems and necessitate new skills and training (Marine IRC’s 2021 Industry Outlook)

While increasing advancements in technology and a growing digital economy offer significant opportunities for Australian industries - increased connectivity also brings increased risks of cyber-attacks by malevolent agents. Recognising this, in October 2020, the Cyber Security Industry Advisory Committee was established by the Government to provide independent strategic advice on Australia’s cyber security challenges and opportunities. The committees report Back to Business Recognising and reducing cyber security risks in the hybrid workforce highlights the importance of collaboration between governments, businesses, and individuals to bolster cyber security awareness. The rapid rise in remote working due to the pandemic has driven demand for increased cyber security awareness and educational programs across the workforce, as well as the need for specialised skills in implementing cyber security policies and procedures.

Other technology factors which are mentioned by industries include:

- Emerging technologies

- Big data and data analytics

- Artificial Intelligence (AI) and machine learning

- More technologically advanced materials and products

- Augmented reality and virtual reality.

Resources and environment

These factors cover issues such as climate change, international action on sustainability, as well as access to reliable internet, and implications for business, the workforce and education and training. Factors include:

- Sustainability action, driving the demand for more sustainable products and services

- Climatic weather shifts and the impact of climate change

- Improving energy efficiency

- Access to quality internet

- Financial viability.

The most prominent resources and environment factor is sustainability action, which is driving the demand for more sustainable products and services. Some industries cite sustainability action as being a potential challenge. This is due to changing customer expectations and changes in approaches to business operations, and challenges in meeting skill requirements. However, most industries identify sustainability action as leading to new opportunities and markets.

A key sustainability action currently underway is the transition to cleaner energy. Australia’s whole-of-economy Long-Term Emissions Reduction Plan sets out how Australia will achieve net zero emissions by 2050. The Plan is based on five key principles, with an enabling role for government. These principles are:

- Technology, not taxes – no new costs for households or businesses

- Expand choices, not mandates – we will work to expand consumer choice, both domestically and with our trading partners

- Drive down the cost of a range of new energy technologies – bringing a portfolio of technologies to parity is the objective of Australia’s Technology Investment Roadmap

- Keep energy prices down with affordable and reliable power – our Plan will consolidate our advantage in affordable and reliable energy, protecting the competitiveness of our industries and the jobs they support

- Be accountable for progress – transparency is essential to converting ambition into achievement. Australia will continue to set ambitious yet achievable whole of-economy goals, then beat them, consistent with our approach to our Kyotoera and Paris Agreement targets.

The plan acknowledges that significant investment will be required to develop a workforce with the right skills and expertise to deploy opportunities in low emission technologies. Specifically, Australia will need a workforce with general capabilities (like communication, problem-solving and digital literacy), as well as discipline-specific skills in fields like construction, physical sciences, engineering, project management and data analytics.

Below are some examples that relate to sustainability action identified by industries:

Solar installation has been steadily growing with currently over two and a half million installations in Australia, which is anticipated to double by the mid-2020s. The renewable sector has the potential to employ over 44,000 by 2025. With the right policy settings, regional areas are poised to benefit as about 70% of these jobs could be in regional Australia by 2025. As many as 50% of clean energy jobs are projected to be in operation and maintenance by 2035. The industry has emphasised the role of training and upskilling workers to leverage from these opportunities (Electrotechnology IRC’s 2021 Industry Outlook).

Hydrogen is a very versatile, low cost, and low emission fuel which can create enormous environmental and economic benefits to take Australia into the future. The workforce will need to be qualified to work with hydrogen safely and competently. Workers require skills and knowledge about hydrogen storage optimisation, repair and maintenance of hydrogen storage equipment, requirements for blending hydrogen with gas, and use of control systems to monitor hydrogen in gas distribution networks. (Gas IRC’s 2021 Industry Outlook)

The effects of climate weather shifts and the impact of climate change were also identified by some industries. This leads to both challenges and opportunities in the need to adapt to changing expectations by both customers and governments. This also presents the need for a workforce that has the skills and knowledge required to respond and manage the various unique industry impacts of climate change and climate weather shifts. The Royal Commission into Natural Disaster Arrangements Report recommended ‘national consistency in training and competency standards’ to encourage resource and information sharing, and to enable ‘someone trained in one state or territory to work effectively in another’

Below are some examples from industry that relate to the impacts of climate change and climate weather shifts

The 2019-2020 bushfires highlighted the important role of animal facility workers, emergency service workers, and evacuation centres in supporting injured and displaced animals. With many evacuation centres overwhelmed, the need for revised evacuation protocols, procedures for accommodating companion animals and staff training were recommended by several reports, including the Royal Commission. (Animal Care and Management IRC’s 2021 Skills Forecast)

All states and territories have implemented several significant changes since the release of the 2020 Bushfire Royal Commission recommendations. Interoperability of personnel and resources has improved through the use of a common incident management system, supporting protocols and procedures, role-based competencies and national industry doctrine. All state and territory fire agencies continue to work collaboratively to further develop workforce capabilities to ensure that interoperability is successfully implemented. (Public Safety IRC’s 2021 Industry Outlook)

Policy and regulatory

This group of factors covers the policy and regulatory landscape which influences the demand for skills. This includes understanding and adhering to the regulatory environment, the policy environment and its implications for businesses and the workforce, and reform in the education and training sector. Factors include:

- Innovation ahead of regulation

- Policy environment

- Appetite for reform

- High and complex regulatory environment

- Safety requirements.

The most prominent policy and regulatory factors mentioned across industry sectors are policy environment and high and complex regulatory environment. For most industries a policy environment and a high and complex regulatory environment are part of the operational environment, either specific to the industry or applied more broadly, and can include:

- Licensed occupations

- Industry standards

- Legislation to manage and protect resources

- Workplace health and safety legislation

- Legislation to protect consumers (noting that these can vary by state or territory)

- Changes to government policy which at times can impact workforce operations, as well as require businesses to update core procedures and processes.

Many industry sectors report the need for business and compliance skills to enable the workforce to negotiate the regulatory environment. Regulation has also led to new technologies in some areas that require new skills. This can also have implications for training package development.

A few policy and regulatory factors identified by some industries include:

The sector is highly regulated across every level, meaning that businesses must adhere to overlapping international, national, state and local compliance legislation…Supporting sustainable fisheries and marine environments has also led to complex regulatory arrangements, licensing issues and quotas that have hampered productivity (Aquaculture and Wild Catch IRC’s Skills Forecast Update 2021)

Operators and workers are faced with challenges in dealing with the consequences of international standards (including ISO), as well as policies and regulation that are driven at federal, state and territory levels, and by local governments and government agencies……. Knowledge about common food groups that cause reactions, identifying and mitigating risks and accurate labelling and regulatory compliance have become critical skills for people producing food, beverages, ingredients, supplements and additives for consumption by humans and animals (Food, Beverage and Pharmaceutical IRC’s Skills Forecast Update 2021)

Some industries also mention a lack of legislation and regulation around new technologies. An example of this is the Information and Communications Technology industry which conveyed concerns over regulation and standards being unable to keep up with the pace of new technology, therefore creating industry-wide challenges relating to product quality. Lagging regulation was also identified by the ESI Transmission, Distribution and Rail Sector, see example below:

Distributed energy resources and other technologies are gaining more traction in Australia. However, energy regulations and policies have been lagging behind. The energy sector has identified policy uncertainty and regulations as a key challenge to address. A coherent energy policy can encourage more investment in distributed energy resources and improvement of integration with the grid. (ESI Transmission, Distribution and Rail IRC’s Industry Outlook 2021).

Method and sources

Methodology

The factors and trends framework has largely been based on the factors outlined in the Miles Morgan report Future skills and training: A practical resource to help identify future skills and training. The report outlines several factors which are influencing the demand for skills in the following broad categories: society and culture, business and economics, technology, resources and the environment, policy and regulatory.

A review of the Skills Forecasts and Industry Outlooks from 2021 alongside other relevant industry literature and data sources has been undertaken to identify which factors are most prevalent for the IRCs.

Employment data has also been provided to show how labour market trends have been shaping the workforce between 2001 and 2021.

Sources

Australian Bureau of Statistics 2020, Gross Value Added (GVA) by Industry, 5204.0 – Table 5, viewed January 2022 https://www.abs.gov.au/statistics/economy/national-accounts/australian-system-national-accounts/latest-release#data-download

- GVA percentage change, 2020-2021

- Top three contributing industries, 2001 and 2021

Australian Bureau of Statistics 2021, Underutilised persons by Age and Sex - Trend, Seasonally adjusted and Original, 6202.0 – Table 22, viewed January 2022 https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia/latest-release

- Unemployment August 2021 (all and 15-24-year-olds)

- Underemployment August 2021 (all and 15-24-year-olds)

Australian Bureau of Statistics 2021, Employed persons by Industry group of main job (ANZSIC), sex, state and territory, November 1984 onwards, 6291.0.55.003 - EQ06, viewed January 2022, https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia-detailed-quarterly/latest-release

- Employed total by ANZSIC 1 digit Industry, 2001 to 2021, August Quarter

- Employed total, percentage change by ANZSIC 1 digit Industry, between 2001 and 2021, August Quarter

- Employed total, percentage change by ANZSIC 3 digit Industry group, between 2001 and 2021, August Quarter, for selected industry sectors

- Employment status, percentage change by ANZSIC 1 digit industry, between 2001 and 2021, August Quarter

Australian Bureau of Statistics 2021, Employed persons by Industry group of main job (ANZSIC), sex, state and territory, November 1984 onwards, 6291.0.55.003 - EQ09, viewed January 2022, https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia-detailed-quarterly/latest-release

- Employed total, proportion of females in workforce, percentage change by ANZSIC 1 digit Industry, between 2001 and 2021, August Quarter

Australian Bureau of Statistics 2021, Employed persons by occupation group of main job (ANZSCO), sex, state and territory, November 1984 onwards, 6291.0.55.003 - EQ08, viewed January 2022, https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia-detailed-quarterly/latest-release

- ANZSCO 1 digit occupation, the percentage change between 2001 and 2021, August Quarter

- ANZSCO 4 digit occupation unit group, the percentage change between 2001 and 2021, August Quarter

Australian Bureau of Statistics 2021, Employed persons by Age and Industry division of main job (ANZSIC), November 1984 onwards, 6291.0.55.003 – EQ12, viewed January 2022 https://www.abs.gov.au/statistics/labour/employment-and-unemployment/labour-force-australia-detailed-quarterly/latest-release

- Employed total, the proportion of workforce aged 49 and under and 50 and over by ANZSIC 1 digit level, 2021, August Quarter

- Employed total, the proportion of the workforce aged 50 and over by ANZIC 1 digit level, percentage change difference between 2001 and 2021, August Quarter

Australian Bureau of Statistics 2021-22, Business conditions and sentiments, viewed February 2022 https://www.abs.gov.au/statistics/economy/business-indicators/business-conditions-and-sentiments

- April 2021, Table 8: Businesses with any staff teleworking prior to COVID-19, by employment size, by industry

- April 2021, Table 11: Percentage of business’s workforce that are currently teleworking, by employment size, by industry

- April 2021, Table 14: Businesses currently experiencing supply chain disruptions, by employment size, by industry

- June 2021, Table 10: Whether businesses were having difficulty finding suitable staff, by employment size, by industry

- June 2021, Table 11: Factors impacting ability to find suitable staff, by employment size

- January 2022, Table 14: Businesses currently experiencing supply chain disruptions, by employment size, by industry

Department of Employment 2021, Employment Projections, available from the Labour Market Information Portal website, viewed February 2022

- Employment projections to November 2025 by main Industry division

Department of Home Affairs 2021, Temporary work (skilled) visa program, Australian Government, Canberra, viewed February 2022 https://data.gov.au/dataset/ds-dga-2515b21d-0dba-4810-afd4-ac8dd92e873e/details

- Temporary resident (skilled) visa holders in Australia between 2017 to 2021 (30th June)

Department of Home Affairs 2021, 2020—21 Migration program report, Australian Government, Canberra, viewed February 2022 https://www.homeaffairs.gov.au/research-and-stats/files/report-migration-program-2020-21.pdf

- Permanent migration skill stream places delivered in program years 2016-17 to 2020-21