Industry insights on skills needs

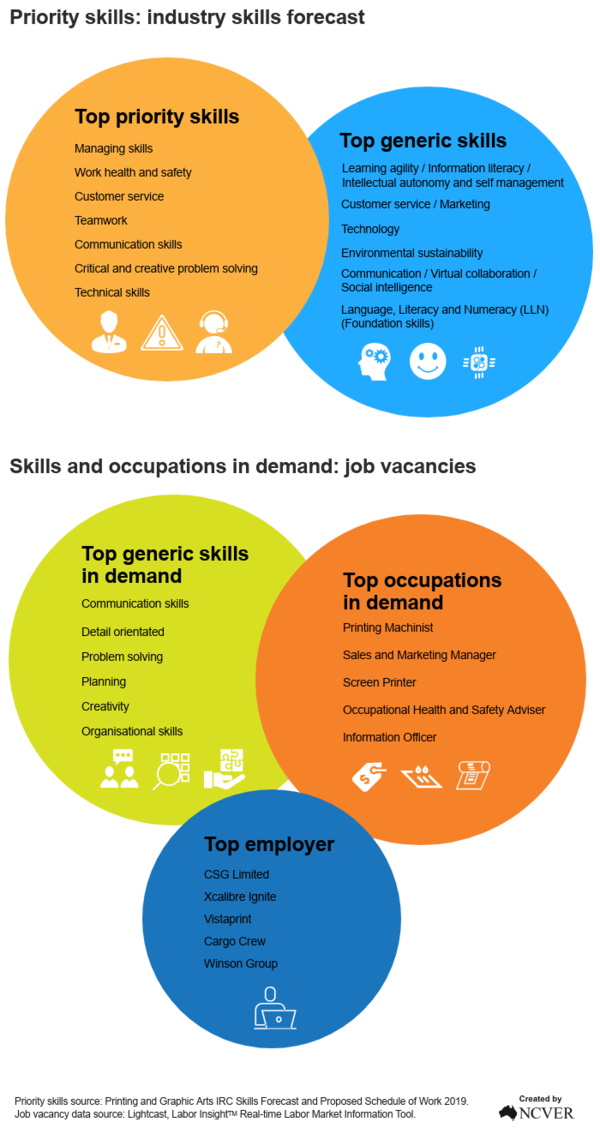

The Printing and Graphic Arts IRC’s 2019 Skills Forecast suggests the following are priority skills for the Printing and Graphic Arts industry:

- Managing skills

- Work health and safety

- Customer service

- Teamwork

- Communication skills

- Critical and creative problem solving

- Technical skills.

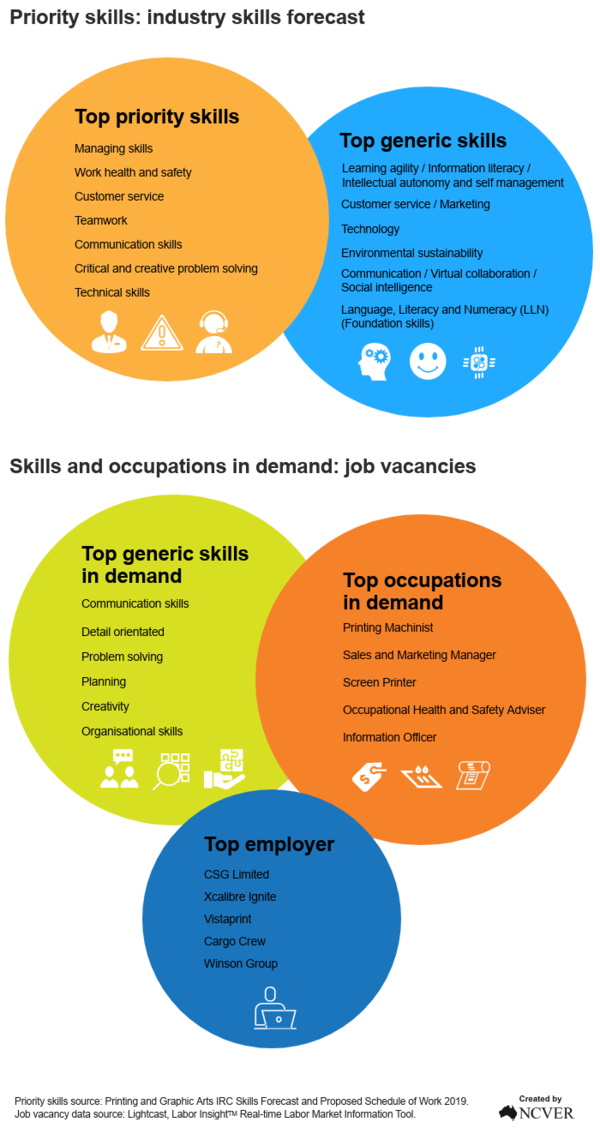

According to the job vacancy data, the top requested skills by employers in the Printing and Graphic Arts industry were communication skills and being detail orientated. The most advertised occupations were Printing Machinist, and Sales and Marketing Manager, and the top employer listed as CSG Limited.

The Printing and Graphic Arts IRC’s 2019 Skills Forecast has identified key drivers for change within the Printing and Graphic Arts industry, an industry which is currently in a period of disruption. These drivers include changing market demand, technological change, and broader product and service offerings.

Changing market demand has caused a level of disruption within the industry, with a decline in some products such as print newspapers and magazines, and potential growth opportunities for other areas of the sector. Potential growth products include printed consumer advertising (e.g. printed catalogues and direct mail), packaging, food labelling and packaging, printing for publishing, general business products and events. These changes to the type of outputs expected from the industry may mean a change in the technical skills required of workers in order produce these products on a range of levels for diverse communication purposes.

Technological change has been highlighted in the Printing and Graphic Arts IRC’s 2019 Skills Forecast as falling into four different categories. The first includes the shift from offset to digital printing technology, meaning that newer digital printing technologies such as commercial inkjet printing are resulting in rapid turnaround printing services, as well as signifying a decrease in the number of technical staff required for the printing process but also requiring workers to have precise time management and prioritisation skills. Secondly, growth in on-demand printing, largely driven by newer printing technology, enables book retailers and publishers to hold digital copies of books and only print books as orders are received presenting potential opportunities with niche or technical publishers. Thirdly, the industry is well positioned to capitalise on parts of the major growth area of 3D printing which is expected to have implications for all industries. Lastly, automation is expected to impact parts of the industry over the longer term, with print production workflow being one area of the sector with the potential for automation.

Broader product and service offerings means that industry workers will increasingly be employed by organisations with a wider product focus such as customisable products, targeted promotional material, emerging product offerings, extended services, multi-channel marketing, sustainability and augmented reality. This widening scope of potential products and services affiliated with the Printing and Graphic Arts industry means workers will be required to broaden their skills and knowledge.

In addition to the changes outlined above, the Printing and Graphic Arts IRC’s 2019 Skills Forecast also describes changes to job roles, meaning workers are increasingly working within multidisciplinary communications teams as opposed to being employed by businesses that solely focus on Printing and Graphic Arts sector related activities. Workers with printing and / or graphic arts skills and qualifications are being employed by a diversity of businesses and industries, so even though it may appear like there is a disruption to sector activity, it may mean workers are being brought in-house into non-printing businesses.

These views are supported by the Printing and Graphic Arts Industry Snapshot, which also reveals revenue in this industry has declined as demand for traditional print products has fallen and prices have been driven down by improved technology. The largest proportion of industry products is advertising materials at 51%, but demand has declined in recent years, largely due to the availability of online alternatives and consumer concerns about the environment.

According to the IBISWorld report Printing in Australia Industry Trends (2015-2020), consumers have increasingly sought information online, and retailers have responded by increasing their digital advertising spend. Traditional print materials are slower and more costly to distribute than digital equivalents. As a result, more businesses have been trading online without using printed materials.

IBISWorld reports that the Printing industry's performance is projected to continue declining over the next five years. As mentioned above, digital alternatives are anticipated to further weaken demand for industry services, particularly in the advertising, magazine and newspaper segments. Changes in the financial and business segments are also likely to reduce demand for printed materials, as more transactions are conducted and processed online. To remain competitive, industry firms may need to focus on niche segments or offer integrated end-to-end services such as designing, marketing consultancy and distribution solutions.

Also affecting this industry are society’s changing attitudes towards environmental issues. Broad concerns over issues such as waste and pollution and their effects on the environment reduce demand for print products. According to the Printing and Graphic Arts Industry Snapshot, environmental concerns were cited by Coles supermarkets in August 2020 as the reason it ceased production of seven million weekly copies of its catalogue. The catalogue used 10,000 tonnes of paper a year, with presses producing 10 billion pages a year for the job.

According to FutureNow, in a drive to ensure workplace succession industry has identified the promotion of the printing industry to schools as a key strategy to promote viable career options to a younger demographic and to shift the public perception of the printing industry.