Food and Pharmaceutical Production and Agriculture

The Food, Beverage and Pharmaceutical IRC’s 2021 Skills Forecast has identified sustainability as a priority, with changes in skills requirements for the sector’s workforce being led by consumer and industry trends, and the regulatory environment, which is highlighted in the following quotes from the skills forecast:

COVID-19 is accelerating the emerging consumer focus on health and wellbeing and ethical, sustainably sourced products, including from plant-based proteins. There is also a broader trend of caution and selectiveness towards brands that demonstrate purpose, transparency and alignment with consumers’ values, including a renewed emphasis on supporting local, independent manufacturing businesses. Aligned with this, Australia’s ‘clean and green’ identity, which is enhanced by strict biosecurity governance, and its reputation for high-quality, trusted and verifiable products is a unique advantage. This is sustained by ‘country of origin’ labelling, blockchain, traceability and provenance investments and initiatives that enable the industry to validate sourcing information, meet consumer demands, support smarter value chains and combat food fraud.

The Food and Agribusiness Growth Centre (FIAL) commissioned report Capturing the Prize includes the agriculture, fishing and food-related manufacturing value chain, including agricultural machinery, seeds and packaged food products sectors. The report includes the quote:

Training institutions are already observing a shift in the way the Australian workforce is responding to changing skill needs. For example, officials at the Australian Institute of Packaging said in an interview that training courses for workers in the packaging industry are focusing more strongly than in the past on recycling, sustainable materials and technical skills. The type of workers attending these courses has also changed over the past couple of years, according to the Institute: from professionals such as packaging technologists and industrial designers to a greater number of attendees with non-packaging backgrounds (such as quality control professionals, sustainability and environmental professionals, or production staff).

The media release from Federation University, a dual-sector tertiary education provider, Federation launches Australia's first hybrid TAFE and university degree includes:

The first half of the degree embeds a Diploma of Food Science and Technology to develop student’s knowledge and core practical skills across food testing, quality and sustainability…Graduates of the new Bachelor of Sustainable Food Systems can expect to work in food safety, product research and development, regulatory affairs and quality assurance, and contribute to activities which promote a circular economy.

The Agricultural industry comprises the following industry sectors:

- Production Horticulture

- Broadacre Farming

- Livestock Farming

- Mixed Crop and Livestock Farming

- Agriculture Support Services

- Agricultural Product Wholesaling.

The Agriculture, Horticulture, Conservation and Land Management IRC’s 2021 Skills Forecast includes:

[Qualifications that] are intended for employment in a niche occupation or specialist industry… often facilitate socially and environmentally valuable or geographically specific skills that are critical for jobs with few employees nationwide. The Diploma in Organic Farming, for example, not only provides the framework for produce to be grown organically and sustainably, it also imparts the leadership skills for companies seeking to be certified as organic. This industry is projected to grow at an annual rate of 15% – which, according to IBISWorld, is the highest of any industry – over the five years through 2024-25, reaching $3.7 billion. This reflects rising consumer demand for information about the provenance of their food and assurances that farming practices take into account climate change by harnessing natural capital through methods such as regenerative agriculture.

The National Agricultural Workforce Strategy includes:

Arguably the most important factor impacting on the AgriFood sector in both Australia and globally is the simultaneous challenge to, on one hand, increase productivity to supply enough nutritious food for a global population still growing at around 160 people per minute and, on the other hand, do this in ways and using systems that also enhance ecosystem health…While sustainability challenges must be met both globally and by each country individually according to its own specific needs and circumstances, the 'front lines' of this battle to enhance the sustainability of our AgriFood systems are farms and agribusinesses and they will require much support to do this. An essential component of this support must be an upskilled, fit-for purpose workforce.

Greenhouse gas (GHG) emissions from agriculture are a major issue for the sector. It is estimated that around 14.5% of current global GHG emissions come directly from agriculture…GHG emissions from agriculture must therefore be mitigated and reduced if the social licence to farm is to be maintained…Increasing production, productivity and profitability in the AgriFood sector at the same time as reducing its GHG footprint will clearly not be based on business as usual; new knowledge, skills and technologies will be required for these essential changes to be made. Each of these will require an upskilled workforce if Australia is to maintain and enhance its competitiveness in global markets, which are becoming increasingly discerning in relation to the environmental impacts of agriculture.

Many studies project net adverse impacts on crop yields due to climate change, and many of those adverse effects will be felt in regions that are at the forefront of both food production and food consumption…Most of the indicators for climate change in Australia paint an equally concerning scenario…Effective and efficient adaptation to climate change is a major challenge for the Australian AgriFood sector if it is to remain sustainable and become more resilient to future climatic perturbations…This level of adaptation will have direct workforce implications, most strongly felt at the regional scale, where changes to what is grown and how it is grown will lead to changing demand for skills and workforce profiles.

The strategy also highlights the cross-industry relationship of maintaining sustainable practices with the quotes:

Sustainability transitions are clearly a team effort with significant implications for greater knowledge and a broader range of skills, not just for the on-farm workforce but also for workers in other parts of the value chain and the service sectors such as agronomists, input providers, banks, and farm insurance agencies.

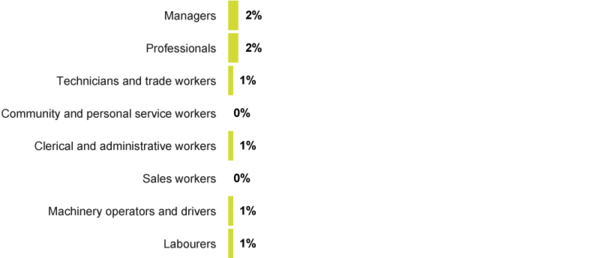

Sustainability transitions will create new job opportunities in the AgriFood sector and require the current workforce to be upskilled. FIAL estimates that opportunities to create healthier soils could increase job numbers by 30% from 2019 to 2030. Equally, it estimates that employment linked to waste collection, disposal and recycling services could double from 2019 to 2030.